Why Mutual Funds?

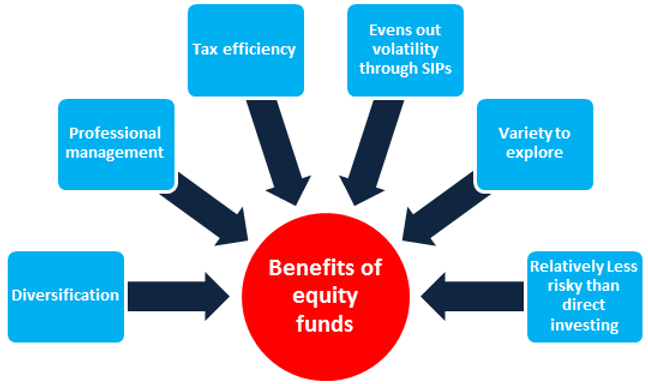

Professional Management - Qualified professionals manage your money, but they are not alone. They have a research team that continuously analyses the performance and prospects of companies. They also select suitable investments to achieve the objectives of the scheme. It is a continuous process that takes time and expertise which will add value to your investment. Fund managers are in a better position to manage your investments and get higher returns.

Choice & Affordability - Mutual funds offer a variety of schemes that will suit your needs over a lifetime. As a small investor, you may find that it is not possible to buy shares of larger corporations. Mutual funds generally buy and sell securities in large volumes which allow investors to benefit from lower trading costs. The smallest investor can get started on mutual funds because of the minimal investment requirements. You can invest with a minimum of Rs.500 in a Systematic Investment Plan on a regular basis.

Diversification - Like the old saying, “Don’t keep all your eggs in one basket”, diversifying your investments will help you lower your risk. By spreading out your money across different types of investments, investing in multiple companies and investing in more than one sector, you ensure that you always have a back-up plan intact. So when you look to invest, always consider a wide range of options. Equity Mutual Funds invest in shares of various companies whereas Debt Funds invest in government securities, NCD, CDs, CPs bonds and other fixed income securities. Thus as an investor, you will be able to have a diversified investment basket via Mutual Funds.

Tax Benefits - Investments held by investors for a period of 12 months or more qualify for capital gains and are exempt / taxed accordingly depending upon type of Mutual Fund. These investments also get the benefit of Indexation.

Liquidity - With open-end funds, you can redeem all or part of your investment any time you wish and receive the current value of the shares. Funds are more liquid than most investments in shares, deposits and bonds. Moreover, the process is standardised, making it quick and efficient so that you can get your cash in hand as soon as possible.

Rupee Cost Averaging (SIP) - With rupee-cost averaging, you invest a specific amount at regular intervals regardless of the investment's unit price. As a result, your money buys more units when the price is low and fewer units when the price is high, which can mean a lower average cost per unit over time. Rupee-cost averaging allows you to discipline yourself by investing every month or quarter rather than making sporadic investments.

Regulations & Transparency - All mutual funds are required to register with SEBI (Securities Exchange Board of India). They are obliged to follow strict regulations designed to protect investors. All operations are also regularly monitored by the SEBI. The performance of a mutual fund is reviewed by various publications and rating agencies, making it easy for investors to compare fund to another. As a unitholder, you are provided with regular updates, for example daily NAVs, as well as information on the fund's holdings and the fund manager's strategy.